sacramento city tax rate

This includes Secured and Unsecured supplemental escaped additional and. Utility User Tax Ordinance pdf Building Permits.

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

The new district tax is for specified city limits and only affects the City of Sacramento.

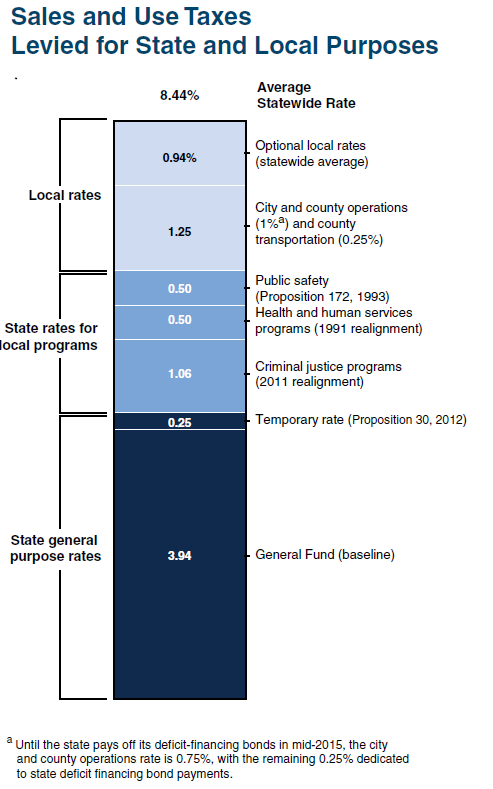

. 5 rows The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025. In West Sacramento the sales tax rate is 825 percent which includes the state-mandated 725 percent plus four separate ¼ cent voter-approved sales tax measures that fund important local projects. The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

The December 2020 total local sales tax rate was also 8750. 075 to city or county operations. Those district tax rates range from 010 to 100.

Studying this recap youll receive a useful insight into real estate taxes in Sacramento and what you should be aware of when your propertys appraised value is set. This is the total of state county and city sales tax rates. Assessor 3636 American River Drive Suite 200 Sacramento CA 95864 916-875-0740 or e-m ail.

Did South Dakota v. Funds from these sales tax measures are used alongside local property tax revenues and other funds to pay for infrastructure public safety flood protection and other. Sacramento county tax rate area reference by primary tax rate area.

Sales tax will increase from 825 to 875 percent. The City of Sacramento does not issue a general business license but does require all businesses that operate in the City of Sacramento to obtain a Business Operations Tax certificate. The County sales tax rate is 025.

Application for Exemption from Business Operations Tax. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Different types of businesses.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of. The California sales tax rate is currently 6. What is the sales tax rate in Sacramento California.

Sellers are required to report and pay the applicable district taxes for their taxable sales and purchases. Stockton San Francisco and Union City will not be affected by this tax. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax.

Motorized and Taxi Permits. California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes ALAMEDA COUNTY 1025 City of Alameda 1075 City of Albany 1075 City of Emeryville 1050 City of Hayward 1075 City of Newark 1075 City of San Leandro 1075 City of Union City 1075 ALPINE COUNTY 725 AMADOR. The minimum combined 2022 sales tax rate for Sacramento California is 875.

They are considered transient if they stay for a period of 30 days or less. The tax rate change effective April 1 2019 is a citywide sales and use tax rate increase for the City of Sacramento and will be one half of one percent 05. Transient Occupancy Tax A Transient Occupancy Tax TOT of 12 is charged for all people who exercise occupancy at a hotel in the City of Sacramento City Code 328.

1788 rows Sacramento. Revenue and Taxation. Business Permit Forms and Instructions.

Looking for a business. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year through e-Prop-Tax Sacramento Countys Online Property Tax Information system. The local sales tax rate in Sacramento County is 025 and the maximum rate including California and city sales taxes is 875 as of April 2022.

VOC 155237 X 00275 42690 tax due. Should you be presently a resident only thinking about moving to Sacramento or planning on investing in its property find out how city property taxes operate. TOT forms are remitted to the City by the hotels on a monthly basis.

11 rows 025 to county transportation funds. View the Boats and Aircraft web pages for more information. Home-Based Business Information pdf and Permit Application pdf Burglar Alarm System Permit.

The Sacramento sales tax rate is 1. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. Transfer Rate The transfer tax is charged at 275 per thousand on the full Value of Consideration VOC Purchase Price.

Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. Some areas may have more than one district tax in effect. The current total local sales tax rate in Sacramento CA is 8750.

Pin Pa Why Is Capital Poor And The Worker Losing Fn

State Tax Rates 2022 What Numbers Determine Your Contributions Marca

Why A Roth Ira Or 401k Might Not Be A Good Idea If Tax Rates Increase Cbs News

Tax Rates Stripe Documentation

Cryptocurrency Taxes What To Know For 2021 Money

California Tax Rates H R Block

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Acct 722 Quiz 3 Solutions 100 Pass Rate In 2021 Income Tax Tax Deductions Financial Statement

Breaking Down State And Local Sales Tax Rates Econtax Blog

Pin By Nathaniel Key On Real Estate In 2021 Boise City Sunnyvale Housing Market

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Understanding California S Sales Tax

Sacramento California Tourist Spots Google Search California Tourist Spots Sacramento Valley Sacramento Airport